I guess you can't blame the students. Most of these young adults have racked up thousands of dollars in debt without thinking much about the long term consequences. The average tuition cost for 2021-2022 academic year was $10,740 for resident students at four year colleges. For out of state students it's double that at $27,560 dollars. Room and board for the academic years runs an additional $11,950.

Is any wonder that the average college student carries a debt of $38,290 according to Experian (this is usually in the form of federal student loans). Private student loan debts amount to $54,921. The total academic debt exceeds $1.74 trillion dollars, and that's the amount Biden is wanting us to pick up the tab for, which begs the question, just where does Biden think that money will come from?

Maybe he thinks we can just take it out of our savings account, but oh wait, nearly a quarter of Americans don't have a savings account. 23% of Americans can't come up with $1000 for an emergency. Of those who do have a savings account, 49% have less than $500 while 36% have $100 or less available!

In fact, according to a 2023 survey by Payroll.org, 78% or over 3/4 of all Americans live paycheck to paycheck, which is a 6% increase over 2022. The average American's household debt runs about $104,250. In 2023, the total mortgage debt of all Americans was $12,252 trillion dollars!So how do most Americans live? They borrow it! The average credit card for household in 2023 was $6,501. Nationally credit card debt amounted to $1,129 trillion dollars. In married households, it common that both adults work. Some often hold down two or sometimes three jobs to make ends meet.

Is it any wonder that 11.6% of Americans live at or below the national poverty line? That's roughly 37.9 million of us. Again, I ask where President Biden thinks we're going to find the money to take on someone else's debt when we can't pay our own? Obviously the student debt---all $1.74 trillion dollars of it---isn't simply going to vanish into the blue.

One way would be for Biden to ask the Federal Reserve to print money to pay the student debt. The problem with that is printing off more money isn't magic. "Someone" still has to pick up the tab, that "someone" is usually the U.S. taxpayer in the form of inflation.

With inflation, the costs of pretty much everything goes up, from food, medical care, and mortgage to the costs of utilities and interests rates on damn near everything, but usually not wages. Thus you have to pay more with the same amount of money.

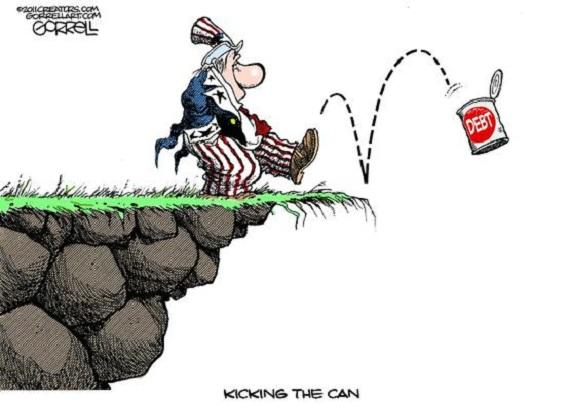

The U.S. sells its debt in the form of Treasury bonds. This, however, is nothing more than kicking the "honey pot" down the road a short piece while paying interest on top of it. Bear in mind too that countries like China, a potential nemesis, owns about 10.17% of our debt (Japan owns the most at 14.52%. The UK is third with 9.16% of our debt). U.S. investors (mostly corporate) owns the most at 32.5% followed by foreign corporate investors which own 29.3%.When looking at college debt, 53% of federal student loan debt is $20,000 or less. 47% of college debt is actually owed by just 10% of college students who have debt in access of $80,000. 51% of those with a bachelor's degree owe under $30,000. 10% of students have private student loans (which also tend to have higher interest rates ) also had almost double the student debt.

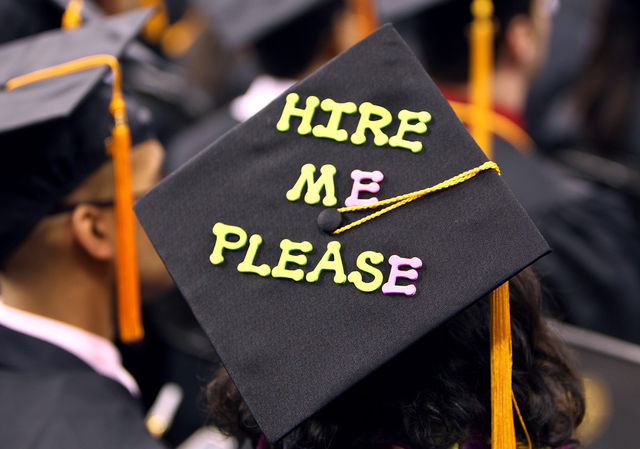

So, with all that debt, how many graduates found work in their chosen field? Most studies show that just 47% are using the their degree in the field of their choice (the majority of those are in fields like computer science, accounting, actuary science, medicine, or law).

What's of note is that 52% of college graduates are underemployed a year after graduation or not working in their academic field. 33% are unemployed one year after graduating. Meanwhile, 47% have jobs which don't require a four year college degree! To put it another way, it means a substantial number of college graduates have degrees in which there is little or no demand for regardless of their GPA and they're stuck with a big ole debt.

Unfortunately, the majority of those going to college are doing so because they've been conditioned to think a college education is the only way to get a decent job. In fact, there's almost an entire industry that's trying to convince high school students to go to college!

They hear it from their teachers, from guidance counselors to college enrollment professionals (many of whom earn a commission for every student enrolled) and companies peddling loans. Many HR people have changed their job requirements to require a four year degree when in the past a simply high school diploma was all that was needed (if that!) without changing the salary or benefit levels very much.In Europe (and most notably Germany which ranks first in the world with a 99% literacy rate and a academic performance ranking of .94% out of 1.00%), they have a much more advanced approach when it comes to education. Children, beginning in pre-school, are evaluated at regular intervals to measure their interests, aptitudes, and academic performance to determine whether a child should be steered toward the trades or higher education.

It needs pointing that in Europe, unlike America, there is no stigma among children going one track or the other, and no child is locked into a given path. They may opt to change direction at their discretion (along with the parent's approval). In addition, as in America, the trades often pay well, they're in high demand, and often offer good benefits. Finding a unemployed plumber, carpenter, or electrician in Europe (or anywhere else) is damn near impossible!

America needed to revamp its academic system and adopt something similar. Not every individual needs to go to college and not every job requires a four year degree...or its crippling debt. Secondly, the requirements to graduate from high school has been repeatedly "dumbed down" since the late 1960's (at the same time schools started throwing out the need for discipline in classrooms). Want proof? Compare a math, English, or science book from the 1950's with one from now. How many students today could successfully get through one? Not many.

We've developed the bad habit of "flunking" students forward out of fear of upsetting their fragile little egos or angering their parents and getting sued. Teachers spend more time babysitting or worrying about getting jumped than teaching. The result is an academic system which has failed everyone.

It's time to return to stronger academic requirements...and performance in order to graduate. For students who don't want to learn or disrupt others, get them out of the classroom since it's doubtful the "board of education" will ever be reintroduced. Nevertheless, there's no reason these individuals should be allowed to interfere with the education of those there to learn.

As an aside, during the 2021/22 school year, Homeland Defense reported 327 school related shootings resulting in 188 deaths or injuries. During the same period, 43% of educators know of a teacher, principal, or someone affiliated with the public school system who've been assaulted by at least one student (often they're jumped by groups). Of this, 20% have been principals. Attacks on school bus drivers have risen 121% between 2001 and 2022. This is completely unacceptable.

Suspending them does no good. That's what they want---to be out of school. Put them to work doing something they don't want to do like janitorial work at the local jail or prison. Maybe assign them to picking up trash along the roads. Send them to a "juvi" bootcamp. Let them find out what life without a solid education is really like.

As an aside, high school teachers and academic advisors need to change their mindset. Not every student needs to be guided toward college or the military. The military is a good option for some people, but not all. Not everyone has the right temperament or physical ability for the military. For those who do, they can get good job training if they pick the right rating or MOS (always think about whether your selected MOS or rating is easily transferable to the civilian world after you get out). The military also offers decent benefits, and you'll sure grow up fast!For those not going to college or lack the urge to "be all they can be", there's the trades. Often overlooked or ignored, the trades are a great way to make a living and provide for a family. First, the pay can be great. So can the benefits. You can work for yourself or someone else (a terrific option to gain experience). You can go union or not. Basic training is generally short and often there is little or no debt. Lastly, there's a huge and growing demand for most all trades. It is a seriously great way to go.

America has a failing (or failed) school system. Academically, the United States ranks 36th in world for mathematics and 24th in science. By comparison, the top five highest scores in math all go to Asian countries. The Scandinavian countries rank in the top tier across the board.

Overall, the U.S. in 33rd out of 44 advanced industrial countries academically, placing us in the middle of the bottom tier. It's common in the U.S. nowadays for employers (including the military) to provide remedial classes in reading comprehension and basic math for so . How do we expect to compete globally with results like that?

Next, employers need to reevaluate their job requirements. Does every position actually require a four year degree? If so, then you need to also reevaluate your pay scale and be prepared to pay out a lot more for your potential new employees. Otherwise, employers need to bring their job requirements more in line with what the job actually calls for.

The world doesn't need another art major any more than it needs another gender or race centered major. If we're to reduce college debt, either colleges are going to need to cut their tuition rates (which won't ever happen) or a new approach is going to have to happen to help graduates quickly gain employment to they can start paying off their debt.That means they need to reassess their choice of majors. All new admissions or undecided majors, along with school councilors, need to review each student's proposed major/minor. Part of the review needs to include a look as the job demand for that particular degree. If there is little or no demand for that job, the applicant must either choose a new major or include a second major (or expanded minor) in a field where there is a demand that's complementary to their major.

For instance, if an applicant choose history as a major, then they need to back that up with courses in something like law, biology, or financial analysis; something where there's an actual demand in the job market. If they choose an art major, then they need to support it with a expanded advertising or marketing minor. The same goes with gender or African-American studies, anthropology, humanities, and so forth. If they combine their desired degree with something employable to fall back on then maybe they can stay out of their parent's basement!

Another opinion is to offer lower interest rates to students pursuing degrees that are in demand, thus making them less of a risk to the lender. The average interest rate among all student borrowers is 6.87% for federal loans (just over 94% of all student loans. For undergraduate loans, it's a little less at 5.50%. For those seeking graduate or professional degrees, the interest rates on loans range from around 7.05% to 8.5%. Interest rates from private lenders varies wildly, typically from 3.99% to 13.99 for fixed rates and 5.24% to 13.99% on variable rates.

Much of this is determined by the borrower's credit history and employment status. Other factors include their current debt load or whether they have a co-signer or not and their credit worthiness. If someone is majoring in a degree where there is a demand, and thus the likelihood of them getting hired quicker, they would obviously be a better credit risk and thus should be rewarded with better credit terms.

But none of this is what President Biden is peddling. His solution is to wave his magic ink pen and make all student debt suddenly disappear---poof! Just like they never promised to pay it back. Maybe this would be their final lesson --- you don't have to take responsibly for the decisions you make. "Someone" (meaning the government) will bail you out, which means everyone else will have to pay for your bad choices and broken promises.If you think about it, it kinda makes sense in a twisted sort of way. The United States is the worse debtor nation in the world. The federal debt tops $34 trillion dollars and yet it routinely spends money it doesn't have. Washington can barely make payment on just the interest, which was $725 billion dollars as of July 2023. That's 14% of entire federal budget. But no worries. They can always raise the debt ceiling and go on their merry way!

At the same time, unlike nearly household in America, Washington has consistently refused to adopt a balanced budget amendment which would prohibit them from spending more than they take in. Is it any wonder then that college graduates and others should expect someone else to pay their bills?

If you enjoyed the article, please consider passing it along to others and don't forget to subscribe. It's free! Lastly please be sure to "like" us on whatever platform you use to read anotheropinionblog.com. It helps beat the algorithms and keeps our articles in circulation. Thank you!

What is the average student loan debt in 2024--- and whatare the impacts?

Average debt in America: 2023 statistics

Nearly Half Have Less Than $500 in Savings: How To Build UpYour Balance in 2024

Average Cost of College Tuition

Living Paycheck to Paycheck Statistics 2024

58 Trade school vs. college statistics for 2022

New college grads are more likely to be unemployed in today's job market

Average Student Loan Interest Rate